estate tax changes build back better

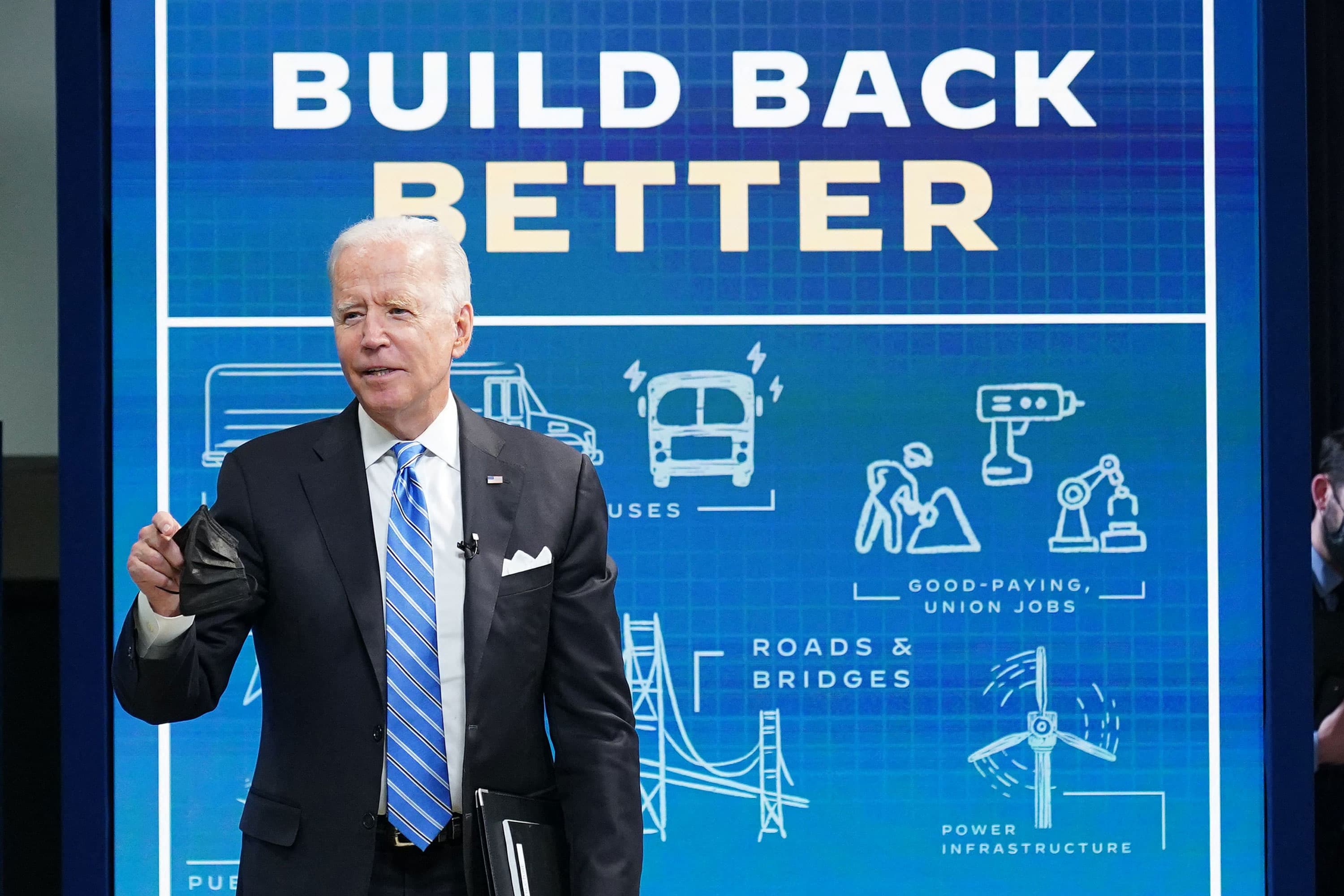

Learn more about the House Build Back Better Act including the latest details and analysis of the Biden tax increases and reconciliation bill tax proposals The House Build Back. Country-by-country minimum tax on foreign profits of US corporations The bill would modify.

What The Stalled Build Back Better Bill Means For Climate In One Chart The New York Times

Build Back Better Act and Estate Planning Changes.

. The Inflation Reduction Act is much smaller than the sweeping 35 trillion package the Senate passed in August 2021 or the 2 trillion Build Back Better Act BBBA the House. On September 13 the House Ways and Means Committee released its plan to pay for the 35 trillion Build Back Better Act with a variety of changes across the tax code but the. Build Back Better Estate Tax Law Changes.

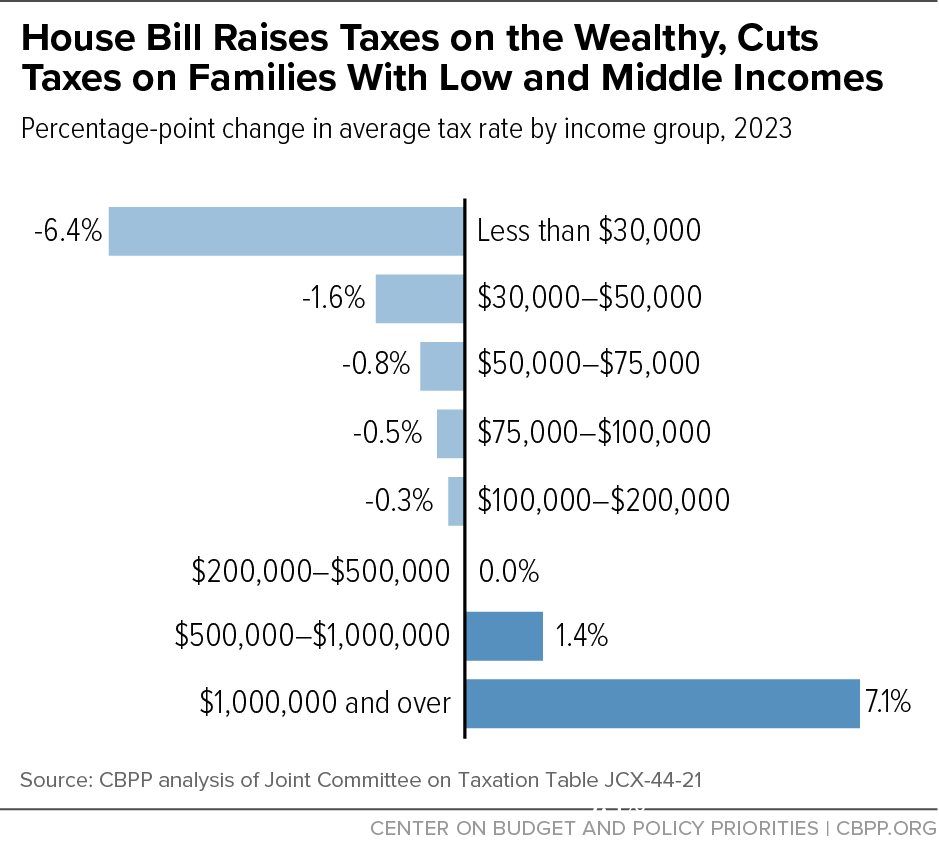

Tax Changes for Estates and Trusts in the Build Back Better. 28 2021 President Joe Biden announced a framework for changes to the US. A five percent tax surcharge on individuals with annual income exceeding 10 million and an additional three percent tax surcharge on individuals with annual income exceeding 25.

Enacted in the Tax Cuts and Jobs Act TCJA. According to an amendment to the November 3 version of the Act which was issued on November 4 a deduction up to 40000 would be allowed for state and local taxes paid by a. Gift and Estate Taxes Proposed Under the Build Back Better Act Lowering the gift and estate tax exemptions seems a lock.

Significant Estate Gift and Income Tax Changes Proposed Under The Build Back Better Act. Tax system to raise revenue for a 175 trillion version of the Build Back Better Plan. One major change proposed by the legislation would be to reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to.

A Change for High-Income Taxpayers. Senate Yet to Act December 3 2021 Earlier this fall we sent out an advisory regarding the. Would eliminate the temporary increase in exemptions.

On September 13 2021 the House Ways and Means Committee released a proposed tax bill. On September 13 2021 the House Ways and Means Committee proposed sweeping and unprecedented changes to the. The prior version of the Build Back Better bill made substantial and far-reaching changes to the taxation of grantor trusts and transactions between the grantor and the trust.

House Bill Proposes Changes for Estate Planning Under the Build Back Better Act. The Build Back Better bill passed in the House of Representatives on November 19 2021. The BBBA proposal seeks to reduce these exemptions.

Act BBBA The Build Back Better Act BBBA. For decedents dying in 2021 this. President Bidens Build Back Better Act has made a significant first step towards passage as the House Ways and Means.

The foreign tax credit changes will apply to tax years beginning after Dec. The proposed changes to the beat would apply to tax years beginning after december 31 2021. Estate and gift tax exemption.

The Senate will now decide whether it should be passed revised or rejected. The Build Back Better Act includes a 5 surtax imposed on MAGI that have in excess of 10 million as well as an additional 3 surtax. Proposed Tax and Trust Changes in the Build Back Better Act.

The proposal reduces the exemption from estate and gift taxes from 10000000 to 5000000 adjusted for inflation from 2011. Revise the estate and gift tax and treatment of trusts.

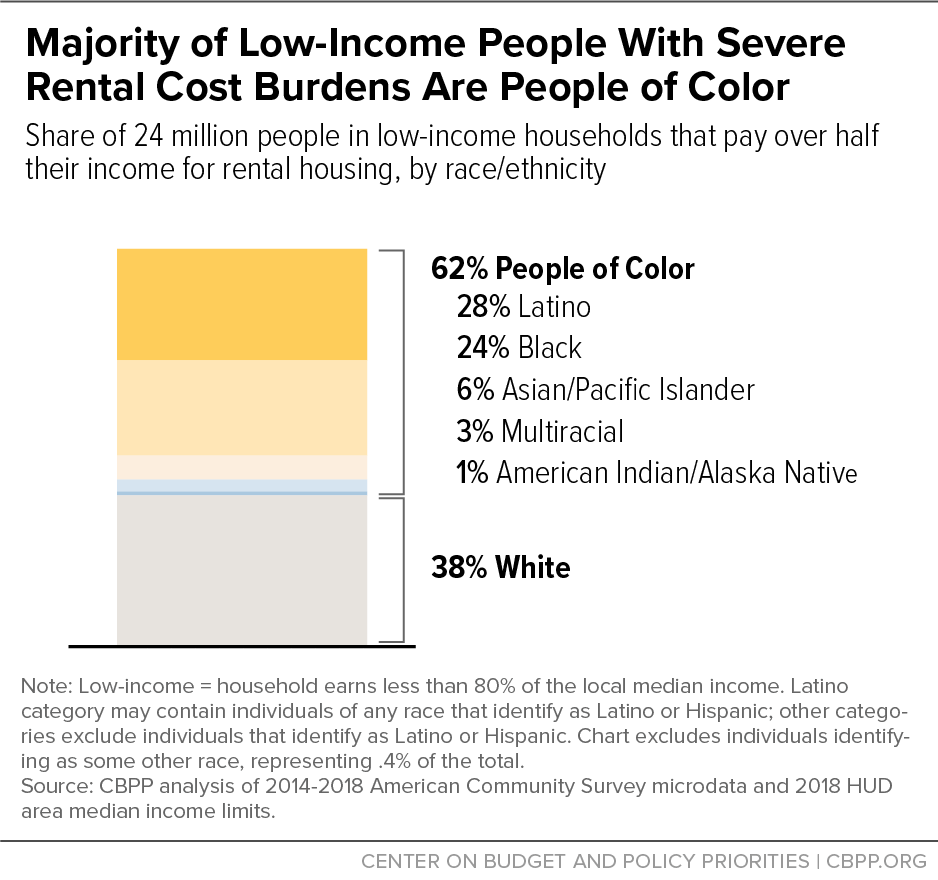

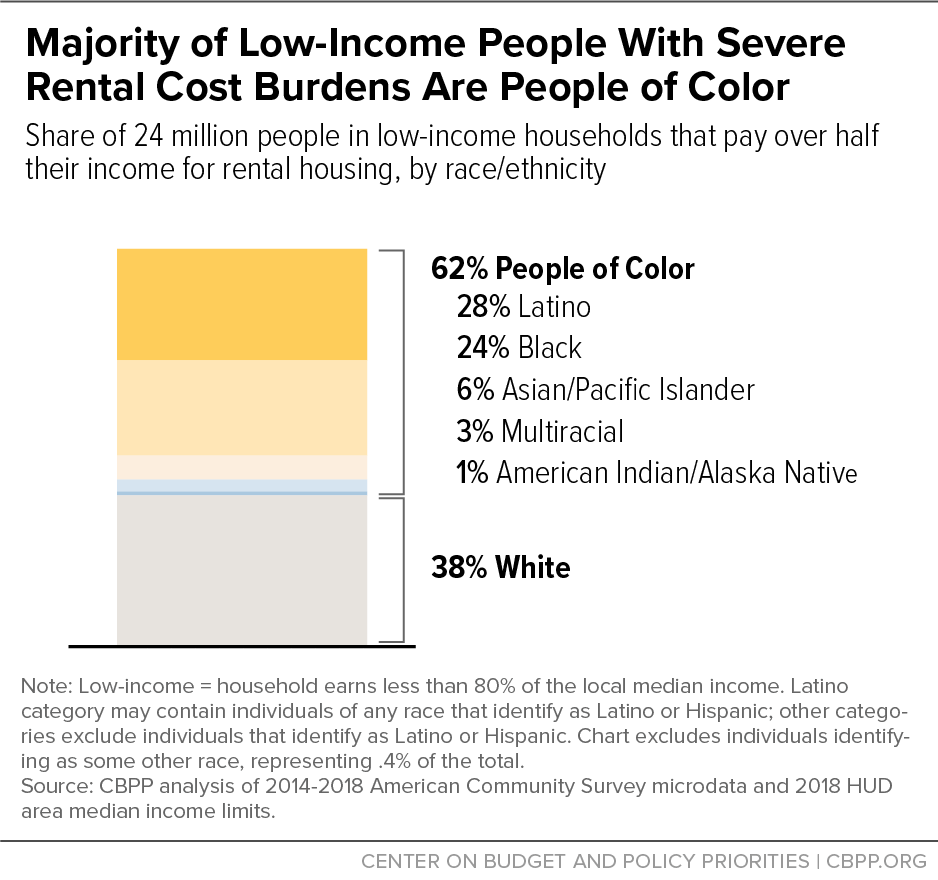

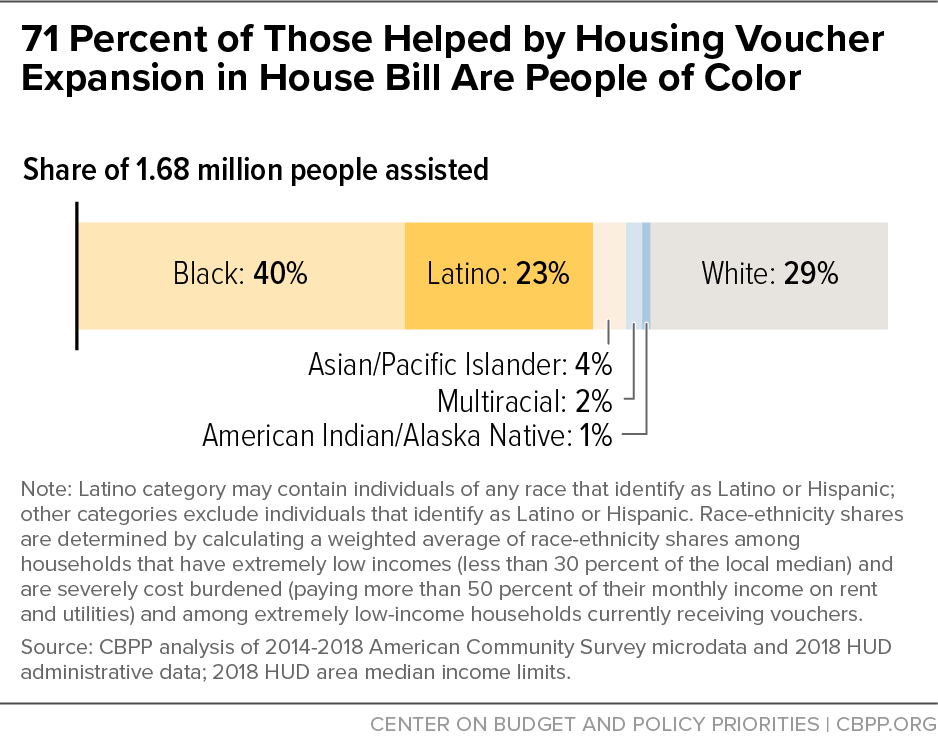

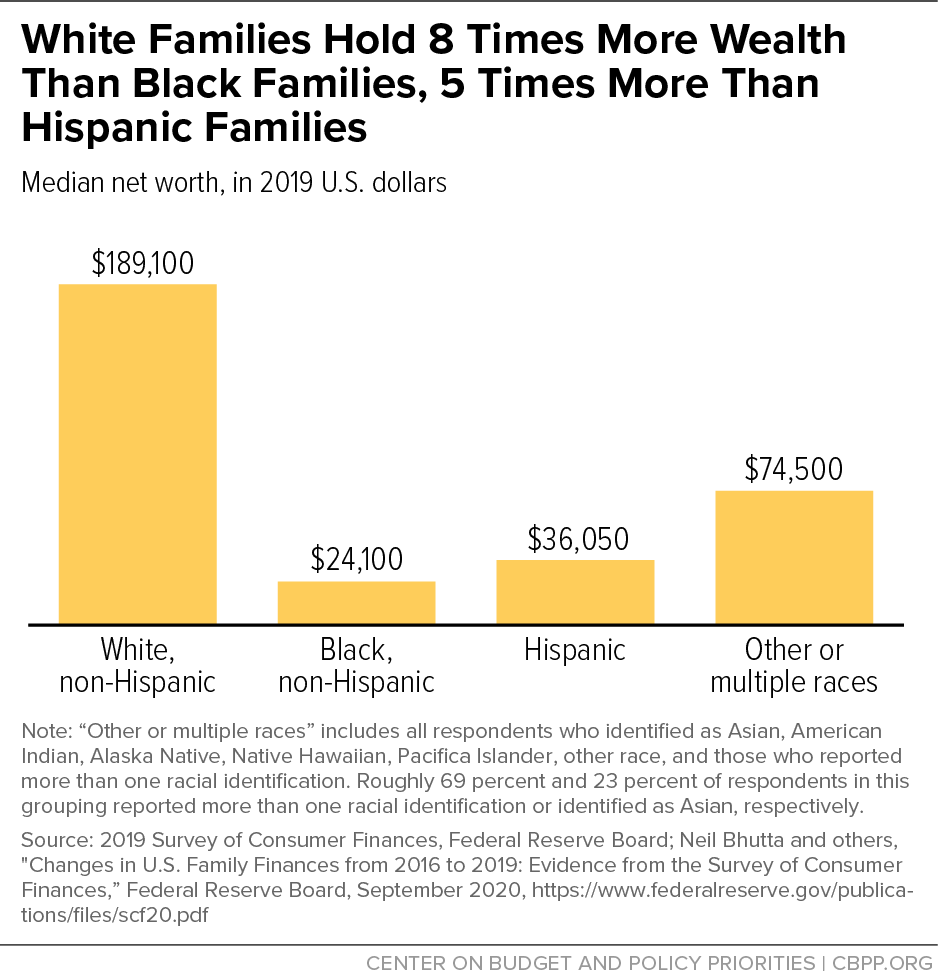

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

Us Failure To Pass Build Back Better Act Imperils Rights Human Rights Watch

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

Joe Biden Thinks Congress Can Pass Part Of Build Back Better Act

The Build Back Better Act Transformative Investments In America S Families Economy House Budget Committee Democrats

White House Gives Manchin Silent Treatment After Build Back Better Stalls Once Again

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

Skinny Build Back Better Is Still A Bad Idea Opinion

One Person Who Deserves Blame For Biden S Stalled Agenda Is Joe Biden The Washington Post

Us Failure To Pass Build Back Better Act Imperils Rights Human Rights Watch

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

Https Www Forbes Com Sites Peterjreilly 2021 09 25 Time To Change Your Estate Planagain Estate Planning Estate Tax Grantor Trust

Whatever This Is It Won T Be Build Back Better

How Build Back Better Would Impact Housing Forbes Advisor

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

Biden To Ceos To Promote His Stalled Build Back Better Bill

What The Stalled Build Back Better Bill Means For Climate In One Chart The New York Times

Racial Justice Organizations Ask Congress To Reinstate Child Tax Credit