vehicle personal property tax richmond va

Failure to receive a tax bill does not relieve you of the penalty and the interest on a past due bill. The county also can consider high mileage and damage beyond regular wear and tear in assigning values to vehicles.

Many Left Frustrated As Personal Property Tax Bills Increase

However all that is little comfort to all those car owners who now must pay a lot more in taxes.

. Use the map below to find your city or countys website to look up rates due dates. The Personal Property Tax rate is 533 per 100 533 of the assessed value of the vehicle 355 for vehicles with specially-designed equipment for disabled persons. If you have an issue or a question related to your personal property tax bill call RVA311 by dialing 311 locally visit.

Opry Mills Breakfast Restaurants. Personal Property Tax Car Richmond Va. If you can answer YES to any of the following questions your vehicle is considered by state law to have a business use and does NOT qualify for personal property tax relief.

Majestic Life Church Service Times. The current personal property tax rate for vehicles in Chesterfield is 360 per 100 of assessed value. Parking tickets can now be paid online.

Personal Property Taxes. Answer the following questions to determine if your vehicle qualifies for personal property tax relief. Is more than 50 of the vehicles annual mileage used as a business expense for federal income tax purposes OR reimbursed by an employer.

It is estimated that by freezing the rate the city will provide Richmonders more than 8 million in additional relief. Depending on your vehicles value you may save up to 150 more because the city is freezing the rate. If you can answer YES to any of the following questions your vehicle is considered by state law to have a business use and does NOT qualify for personal property tax relief.

Call 804 646-7000 or send an email to the Department of Finance. We are open for walk-in traffic weekdays 8AM to 430PM. Is more than 50 of the vehicles annual mileage used as a business.

Restaurants In Matthews Nc That Deliver. Restaurants In Erie County Lawsuit. Virginia law makes vehicles with an active Virginia registration taxable in the municipality where the vehicle is registered - even if the vehicle is garaged or parked in another state.

12000 Government Center Parkway Suite 223. Team Papergov 1 year ago. Richmond City has one of the highest median property taxes in the United States and is ranked 394th of the 3143 counties in order of median property taxes.

Richmond City collects on average 105 of a propertys assessed fair market value as property tax. Glenn Youngkin is trying to make it easier. City of Colonial Heights 201 James Avenue PO.

Pay Your Parking Violation. Box 3401 Colonial Heights VA 23834 Phone. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as of January 1 st of each tax year.

Tax rates differ depending on where you live. 804 520-9266 Hours 830 AM - 500 PM View Staff Directory. The median property tax in richmond city virginia is 2126 per year for a home worth the median value of.

As a result some County residents may not be aware that a tax. Commissioner of the revenue means the same as that set forth in 581-3100For purposes of this chapter in a county or city which does not have an elected commissioner of the revenue commissioner of the revenue means the officer who is primarily responsible for assessing motor vehicles for the. Interest is assessed as of January 1 st at a rate of 10 per year.

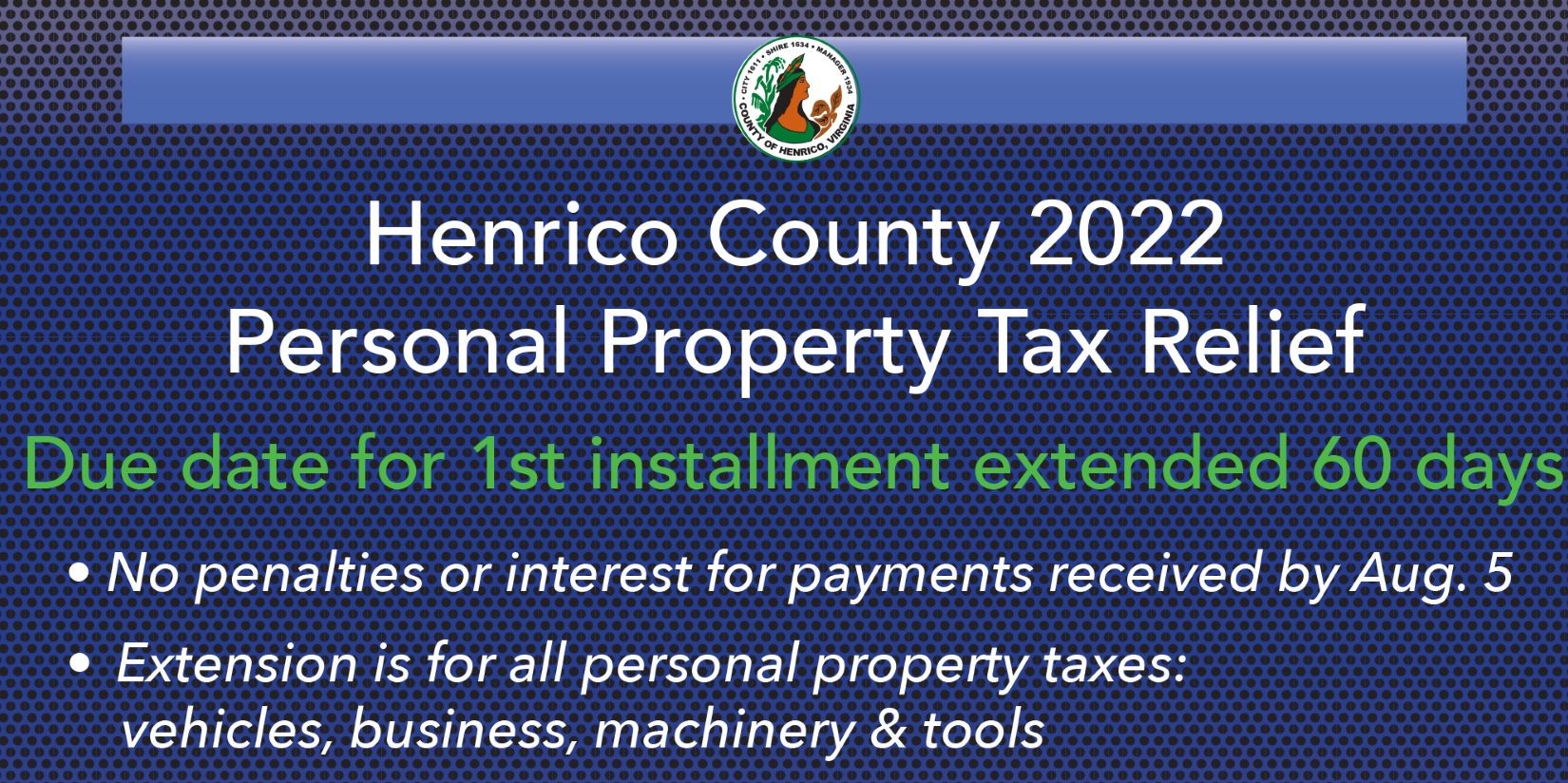

In addition Henrico maintains a personal property tax rate for vehicles of 350 per 100 of assessed value which is the lowest among major localities in the region. As used in this chapter. 18 hours agoGOOCHLAND Va.

Parking Violations Online Payment. Real Estate and Personal Property Taxes Online Payment. Which holds a grand re-opening after 30 million renovation in Richmond Va on.

Tight used car market driving up personal property taxes and more Va. At the calculated PPTRA rate of 30 you would be required to pay. If you have questions about your personal property bill or would like to discuss the value.

Ned Oliver Virginia Mercury The tight supply of used cars is causing some Virginians to take a hit on personal property taxes due to big increases in vehicles assessed value. The county also can consider high mileage and damage beyond regular wear and tear in assigning values to vehicles. Personal Property Registration Form An ANNUAL filing is required on all.

If you have questions about personal property tax or real estate tax contact your local tax office. Richmond VA 23235 8043201301. WRIC The Goochland County Board of Supervisors announced on Thursday May 19 that the deadline for residents to pay real estate and personal property taxes has been extended.

1 day agoRichmond city officials on Monday will introduce legislation to push the June 5 due date for personal property tax bills to Aug. Personal Property Taxes are billed once a year with a December 5 th due date. If you have questions about your personal property bill or would like to discuss the value.

Although jurisdictions throughout Virginia levy a personal property tax many US. Are Dental Implants Tax Deductible In Ireland. The 10 late payment penalty is applied December 6 th.

Click Here to Pay Parking Ticket Online. An example provided by the City of Richmond goes like this. Personal Property taxes are billed annually with a due date of December 5 th.

703-222-8234 TTY 711. Use our website send an email or call us weekdays from 8AM to 430PM. If your vehicle is valued at 18030 the total tax would be 667.

Personal Property Tax Relief 581-3523. The median property tax in Richmond City Virginia is 2126 per year for a home worth the median. The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800.

Local Taxes Personal property taxes and real estate taxes are local taxes which means theyre administered by cities counties and towns in Virginia.

Virginia Localities Pushing Tax Relief As Car Values Go Up Dcist

Get The Title Of Property Reviewed Before Selling Title Insurance Title Buying A New Home

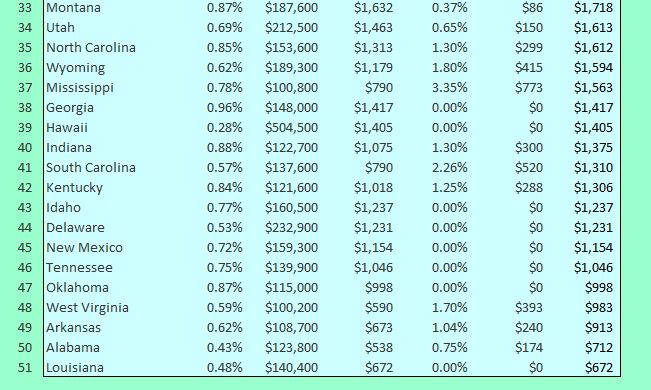

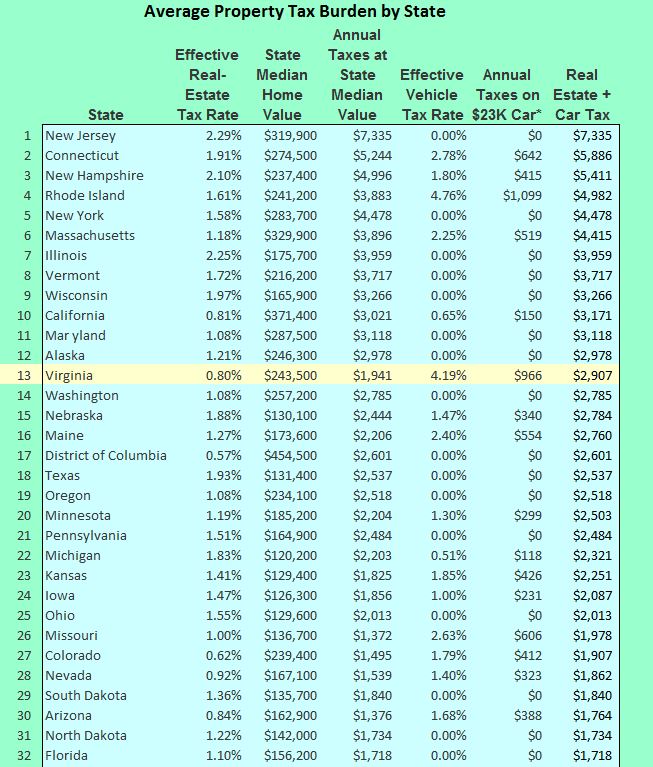

Virginia Property Taxes Not As Bad As Jersey But Worse Than D C Bacon S Rebellion

Pay Online Chesterfield County Va

Virginia Property Tax Calculator Smartasset

Real Estate Tax Exemption Virginia Department Of Veterans Services

Decal Debate Other Counties Have Abandoned The Windshield Sticker Should Loudoun Join Them Loudoun Now

Virginia Property Taxes Not As Bad As Jersey But Worse Than D C Bacon S Rebellion

Property Taxes How Much Are They In Different States Across The Us

Many Left Frustrated As Personal Property Tax Bills Increase

Henrico County Announces Plans On Personal Property Tax Relief

Aba Tax Services Xero Accountant Property Business And S M S F Specialists Business Insurance Small Business Insurance Car Insurance

Drone Laws In Virginia Updated February 19 2022

Soaring Home Values Mean Higher Property Taxes

The Differences Between Va Md And Dc Taxation Lipsey Associates

Henrico County Government Henriconews Twitter

Youngkin Signs Bill To Reclassify Certain Vehicles And Personal Property Tax Rates Wric Abc 8news

Henrico County Announces Plans On Personal Property Tax Relief