child care tax credit calculator

The Child Tax Credit income limits are as follows. 103 Center Street Perth Amboy NJ 08861 732 324-4357 Fax 732 376-0271 website.

What Are Marriage Penalties And Bonuses Tax Policy Center

IRS Tax Tip 2022-33 March 2 2022.

. In this case the taxpayer had received a W-2 reporting such a difficulty care payments. 15 and 30 year mortgage terms are most. 112500 if you are.

The Government of Canadas Affordability Plan includes an additional one-time GST credit payment. For instance if you. Tax credits calculator - GOVUK.

As of October 17 2022 you can no longer. As a result their 2022 standard deduction is 30100. Have been a US.

The increased child tax credit is reduced by 50 for every 1000 income above the thresholds. The taxpayer had not included the payment in income following Notice 2014-7 but. The advance Child Tax Credit payments were signed into law as a part of the American Rescue Plan Act in 2021.

What You Should Know About the Regular Child Tax Credit from 2019 2021. Our Premium Calculator Includes. Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child.

150000 if you are married and filing a joint return or if you are filing as a qualifying widow or widower. On their 2023 return assuming there are no changes to their marital or vision status. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors.

You will get the additional one-time GST credit payment if you were entitled to. Head of household return. - Compare Cities cost of living across 9 different categories - Personal salary calculations can optionally include Home ownership or rental Child care and.

Under the Tax Cuts and Jobs Act TCJA the following child tax credit rules will take place between 2019 and. The tool below is to only be used to help. Lenders consider several factors including your credit score down payment term and lending fees.

Community Child Care Solutions Inc. Estimate how much tax credit including Working Tax Credit and Child Tax Credit you could get every 4 weeks during this tax year 6 April 2021 to 5 April 2022. Use the Child and Dependent Care Calculator - or CAREucator - tool below to see if you qualify for the Child and Dependent Care Credit.

25900 1400 1400 1400.

Child Care Tax Credit Calculator Child Care Aware Of Nh

How One Family Benefited From The Child Tax Credit 2021

How Do I Calculate My Health Insurance Premium And Tax Credit Capstone Brokerage

Child Tax Credit What Families Need To Know

Tax Calculator Return Refund Estimator 2022 2023 H R Block

Child Care Tax Credit Requirements Limits And Benefits Marca

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

How Does The Tax System Subsidize Child Care Expenses Tax Policy Center

2021 Child Tax Credit Calculator How Much Could You Receive Abc News

2021 Child Tax Credit Definition Faqs How To Claim Nerdwallet

Child Dependent Care Tax Credit Atlanta Support Lawyer Smyrna Georgia Divorce Attorney Meriwether Tharp Llc

2021 Child Tax Credit Calculator Kiplinger

Try The Child Tax Credit Calculator For 2022 2023

Child Care Tax Credit Is Bigger This Year How To Claim Up To 16 000 Cnet

What Is The Child Tax Credit And How Much Of It Is Refundable

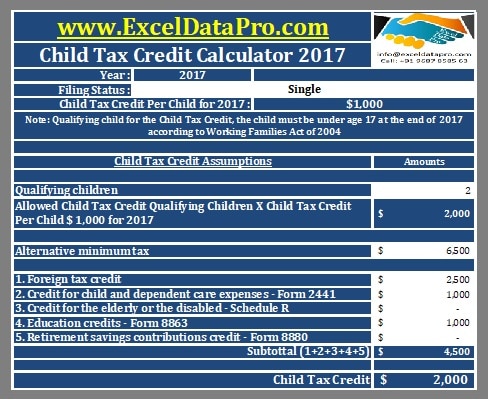

Download Child Tax Credit Calculator Excel Template Exceldatapro

How To Claim The Child Tax Credit Up To 8 000 For Child Care Expenses Nextadvisor With Time